how to answer are you exempt from federal withholding

Until the employee furnishes a new Form W-4 the employer must withhold from the employee as from a single person. If however a prior Form W-4 is in effect for the.

How Long Can You Claim Exemption Without Owing Taxes Quora

If you can be claimed as a dependent on someone elses tax return you will need an estimate of your wages for this year.

. You can claim up to three allowances on the W-4 form. On the form youll enter your personal information. If an employee wants to claim exemption they must write Exempt.

Your status as a full-time student doesnt exempt you from federal income taxes. Should a high school student claim exempt on w4. If you want to claim exemption from withholding you need to fill out a new Form W-4 and submit it to your employer.

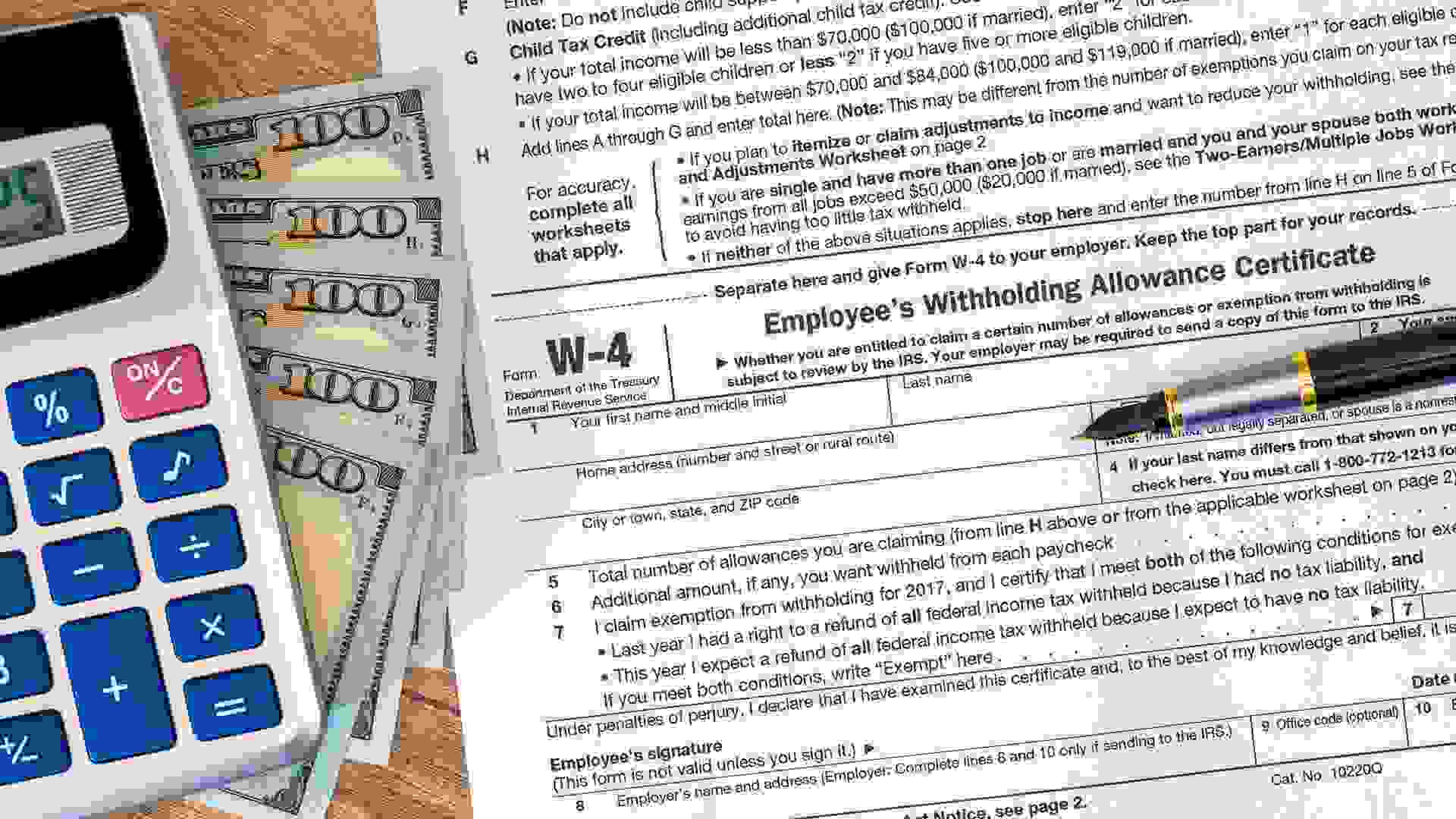

This form is completed by the employer and instructs them on how much to deduct from each paycheck. If you are shown as exempt from federal taxes it means your employer does not withhold any federal tax from your paycheck. The more allowances you claim the less your employer will withhold from each check and send to the government.

An estimate of your income for the current year. Write Exempt in the space below Step 4c Complete Steps. You need to indicate this on your W-4.

Defining Tax Exempt Tax-exempt refers to income or transactions that are free from tax at the federal state or local level. Your company will deduct. You may claim EXEMPT from withholding if.

If you want to claim complete exemption from. The reporting of tax-free items may be on a. If youre a US.

To claim exempt write EXEMPT under line 4c. If you had no tax liability in the prior year and you do not expect to owe anything in the current year you might qualify to be exempt from federal income tax withholding. O Last year you had a right to a full refund of All federal tax income and o This.

A new W-4 form is now in effect for all new hires and employees who want to change their W-4 forms. To claim exempt from federal withholding you need to fill out a W-4 Form and write the word EXEMPT on line 7.

Reporting Foreign Income Eight Tax Tips From The Irs 1 Internal Revenue Service Internal Revenue Service Irs Income

Do I Pay Taxes On Workers Comp Larry Pitt

Learn How To Fill Out A W 9 Form Correctly And Completely

Solved Federal Taxes Not Deducted Correctly

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Am I Exempt From Federal Withholding H R Block

How To Fill Out A W4 2022 W4 Guide Gusto

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates

Appendix 13c Income Taxes And The Net Present Value Method Answer Key Provided At The End Income Tax Income Net Income

Donor Centered Thank You Letters Your First Step To The Next Gift Burks Blog Thank You Letter Mission Trip Fundraising Letter Thank You Letter Template

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Letter Sample Name Change Business Template

How Do I Know If I Am Exempt From Federal Withholding

A Beautiful Infographic To Share The Similarities And Differences Of Banks And Credit Unions Infographic Credit Union Credit Repair Credit Repair Services

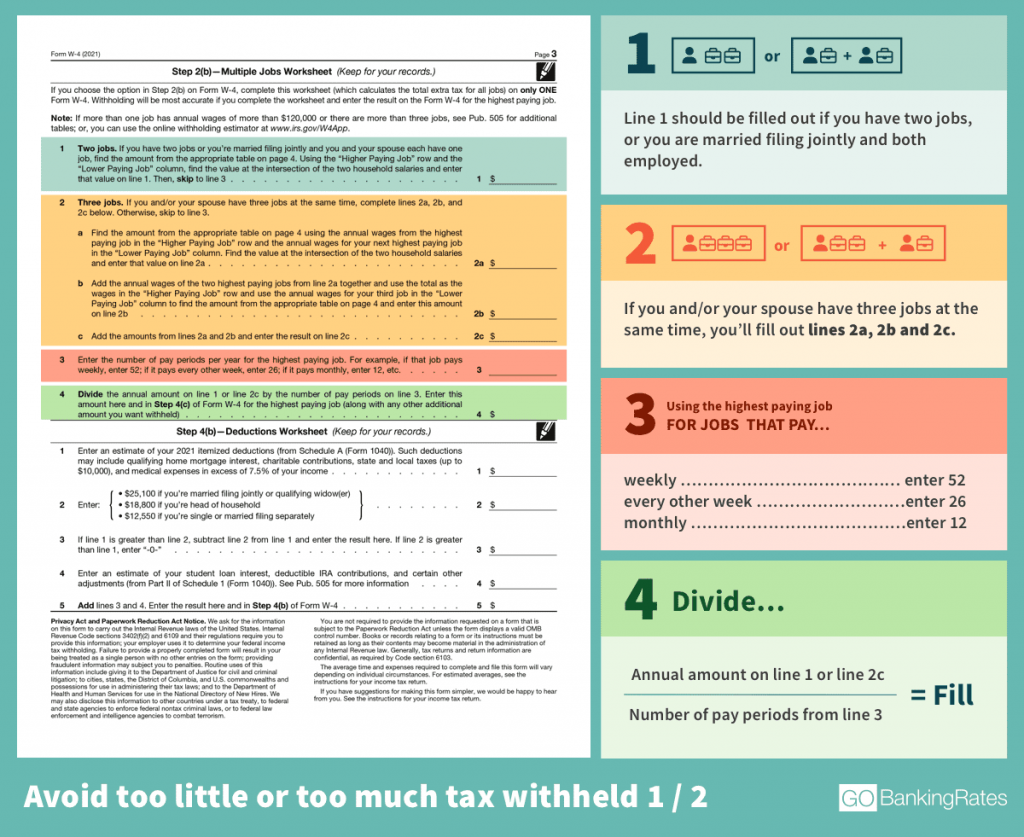

How To Fill Out A W 4 A Complete Guide Gobankingrates